Edward Jones TRU-7791-A 2013-2024 free printable template

Show details

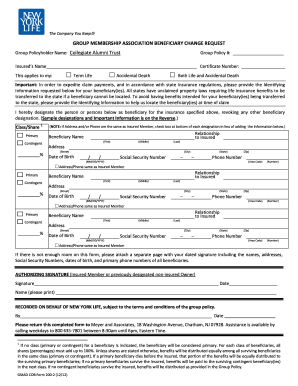

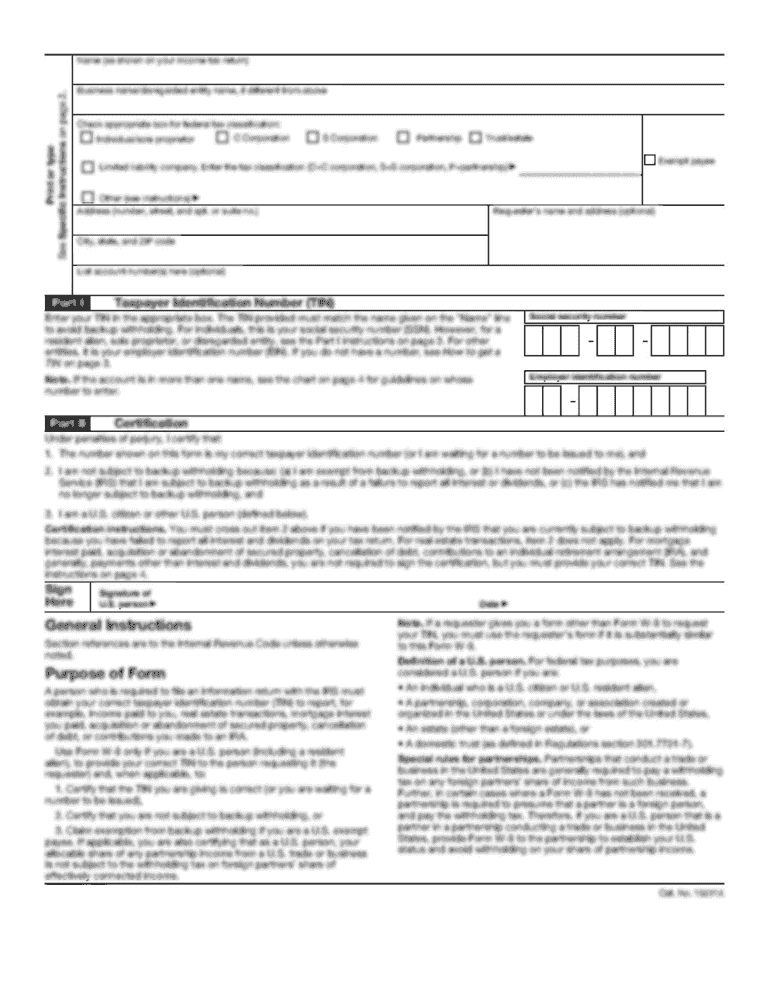

Edward Jones Trust Company Individual Retirement Account Authorization Form and Beneficiary Designation A. Account Holder Information Name: Address: City: State: Date of Birth (DOB)/Trust: Social

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your edward jones beneficiary form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your edward jones beneficiary form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing edward jones beneficiary form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit edward jones change of beneficiary form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out edward jones beneficiary form

How to fill out Edward Jones beneficiary form:

01

Obtain the Edward Jones beneficiary form from your financial advisor or directly from the Edward Jones website.

02

Read the instructions carefully to understand the required information and any specific guidelines for filling out the form.

03

Provide your personal information, such as your name, address, phone number, and social security number, as required on the form.

04

Identify the type of account for which you're designating a beneficiary, and include the account number or any other required account details.

05

Clearly indicate the beneficiary's full name, relationship to you, and their contact information, including address and phone number.

06

If you want to designate multiple beneficiaries, specify their percentage allocation or any other instructions according to the form's guidelines.

07

Sign and date the beneficiary form, ensuring that it is witnessed or notarized if required.

08

Keep a copy of the completed form for your records, and submit the original form to your Edward Jones financial advisor or the designated address mentioned on the form.

Who needs Edward Jones beneficiary form:

01

Clients who have investment accounts or other financial products with Edward Jones might need to complete the beneficiary form.

02

Individuals who want to ensure that their assets are transferred to specific individuals or organizations according to their wishes upon their demise.

03

It is particularly important for those who want to avoid potential complications or disputes regarding the distribution of their financial assets and want to have a legally valid and documented beneficiary designation.

Fill edward jones beneficiary claim form : Try Risk Free

People Also Ask about edward jones beneficiary form

How do I fill out a beneficiary change form?

Do you need to fill out a beneficiary form?

Are beneficiary forms required?

What are beneficiary forms?

How much is Edward Jones transfer on death fee?

What is the purpose of a beneficiary form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file edward jones beneficiary form?

Edward Jones requires all account holders to file a beneficiary form. This form is used to designate who should receive the assets in the account in the event of the account holder's death.

What is the purpose of edward jones beneficiary form?

The Edward Jones Beneficiary Form is used to designate a beneficiary or beneficiaries of your account assets after your death. The form is used to ensure that your assets are distributed to your desired beneficiary or beneficiaries in accordance with your wishes.

When is the deadline to file edward jones beneficiary form in 2023?

The deadline to file Edward Jones beneficiary forms in 2023 will depend on the specific details of the policy. Generally, beneficiaries must be designated by the policyholder and the form must be completed and submitted to the company within 30 days of the policyholder's death.

What is the penalty for the late filing of edward jones beneficiary form?

The penalty for the late filing of an Edward Jones beneficiary form depends on the type of account held and the financial institution in question. Generally, the penalty for late filing of a beneficiary form will include a fee for processing the form and a delay in the release of funds. Contact Edward Jones directly for more information about specific penalties for late filing.

What is edward jones beneficiary form?

Edward Jones beneficiary form is a legal document that allows an account holder of an Edward Jones investment account to designate a beneficiary or beneficiaries to receive the assets of the account in the event of their death. This form ensures that the account holder's intentions regarding the distribution of their assets are clearly stated and legally binding. The beneficiaries designated on the form will inherit the assets directly, bypassing the probate process.

How to fill out edward jones beneficiary form?

To correctly fill out an Edward Jones beneficiary form, follow these steps:

1. Obtain the beneficiary form: You can request a beneficiary form from your Edward Jones financial advisor or download it from the Edward Jones website.

2. Provide your personal information: Begin by entering your full name, address, phone number, and Social Security number at the top of the form.

3. Identify the account: Indicate the specific investment or account for which you are naming beneficiaries. This could be an individual investment account, retirement account (e.g., IRA, 401(k)), or life insurance policy.

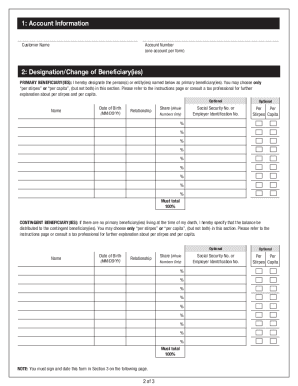

4. Specify primary beneficiaries: Enter the names, relationship to you (e.g., spouse, child, sibling), Social Security numbers, dates of birth, and contact information for your primary beneficiaries. You can typically designate multiple primary beneficiaries and specify the percentage of assets each will receive.

5. Designate contingent beneficiaries: Provide the same information as step 4 for your contingent beneficiaries. Contingent beneficiaries only inherit assets if all primary beneficiaries predecease you or are unable to claim the assets.

6. Decide on distribution: Depending on your preferences, you may choose to distribute assets equally among primary beneficiaries or allocate specific percentages to each. The total percentages assigned should add up to 100%.

7. Sign and date: Sign and date the form at the bottom. Some beneficiary forms may require a witness or a notary public to validate your signature, so be sure to follow any additional instructions provided.

8. Submit the form: Return the completed beneficiary form to your Edward Jones financial advisor or as instructed by the company. Keep a copy for your records.

It's important to review and update your beneficiary designations periodically, particularly after significant life events such as marriage, divorce, the birth of a child, or the death of a beneficiary. Consulting with a financial advisor or estate attorney may help ensure your beneficiary designations align with your overall estate plan.

What information must be reported on edward jones beneficiary form?

When filling out a beneficiary form for Edward Jones, the following information must typically be reported:

1. Account holder information: Name, address, social security number, and contact details of the account owner.

2. Beneficiary information: Name, address, social security number, and contact details of each beneficiary.

3. Relationship to the account holder: Indicate the relationship between the account holder and each beneficiary (e.g., spouse, child, sibling, friend).

4. Percentage allocation: Specify the percentage or fraction of the account to be distributed to each beneficiary. The total percentage should add up to 100%.

5. Contingent beneficiary information: If desired, provide details of alternate or contingent beneficiaries who would receive the proceeds if the primary beneficiaries are unable to receive them.

6. Signature: The account holder must sign and date the beneficiary form to confirm its accuracy and validity.

It's important to note that specific requirements and forms may vary depending on the type of account, local regulations, and Edward Jones policies.

How can I modify edward jones beneficiary form without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your edward jones change of beneficiary form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit edward jones beneficiary designation form straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing edward jones forms.

Can I edit edward jones beneficiary payout on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign edward jones beneficiary change form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your edward jones beneficiary form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Edward Jones Beneficiary Designation Form is not the form you're looking for?Search for another form here.

Keywords relevant to edward jones beneficiary form

Related to how to change beneficiary on edward jones account

If you believe that this page should be taken down, please follow our DMCA take down process

here

.